2017中国国际(香港)债券论坛

时间:2017-10-12 08:00 至 2017-10-13 18:00

地点:香港

- 参会报名

- 会议介绍

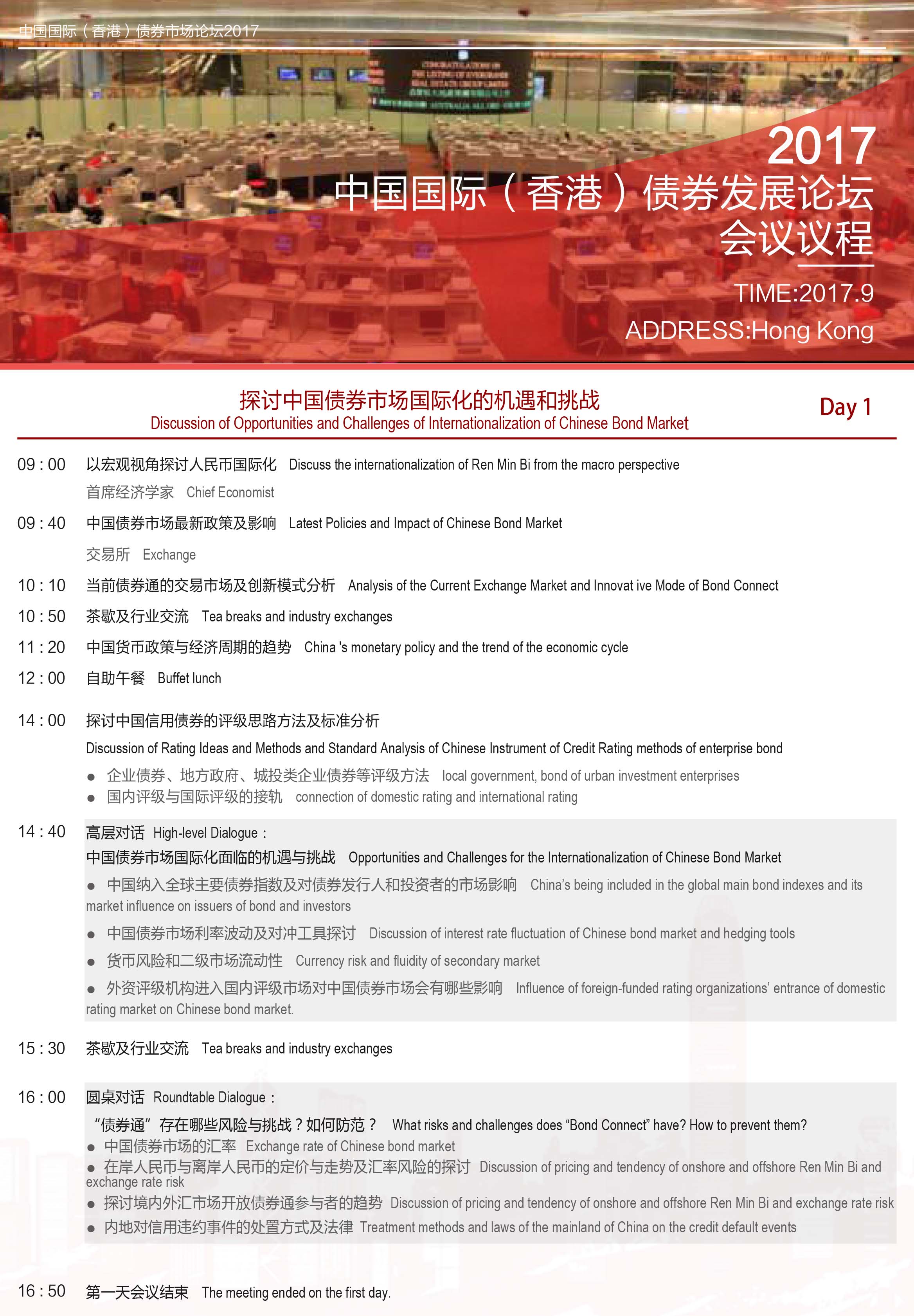

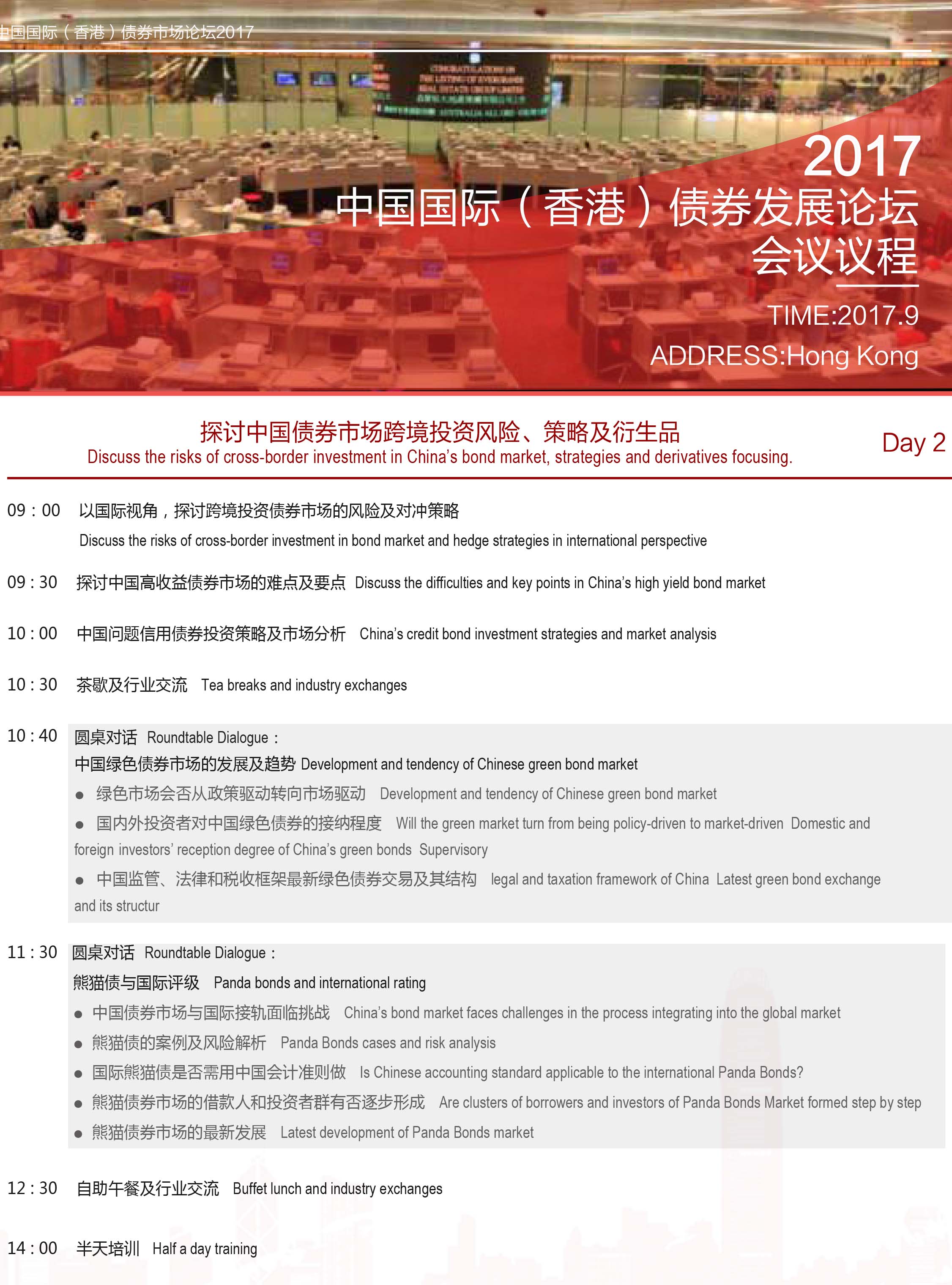

- 会议日程

- 会议嘉宾

- 参会指南

-

手机下单

|

2017中国国际(香港)债券论坛 已截止报名会议时间: 2017-10-12 08:00至 2017-10-13 18:00结束 会议规模:300人 主办单位: 通达金融

|

会议介绍

会议介绍

会议内容 主办方介绍

2017中国国际(香港)债券论坛宣传图

论坛背景 Background

继“沪港通”“深港通”之后,中国的金融市场进一步对外开放。5月16日央行和香港金融管理局联合公告宣布,内地与香港将开展债 券市场互联互通合作。目前内地债券市场在全球排名第三,仅次于美国和日本。开通“债券通”有助优化两地债券市场基础设施的互联 互通和跨境合作,进一步便利投资者参与债券市场。随着境内债券市场的开放和中国资本流动管制措施的减少,未来投资境内债券市场 的境外资金规模理论上可以呈几何级数增长。

Following Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect, China further opens its financial market. The People's Bank of China and Hong Kong Monetary Authority jointly announced on May 16 that, a cooperation connecting the Mainland China and Hong Kong will be carried out. As the bond market in the Mainland China ranks third in the global market, only next to the United State and Japan, the “Bond Connect” can help optimize the interconnection of the Mainland China and Hong Kong in bond market infrastructure and cross-border cooperation, further facilitate the participation of investors in bond market. With the opening of bond market of the Mainland China and reduction of China’s regulative measures on flow of capital, it can be expected that the offshore funds investing in the bond market of the Mainland China could have a exponential grow.

近年来,中国经济保持中高速增长,债券市场发展成效显著,人民币债券资产的吸引力不断上升。彭博、花旗等国际债券指数提供商先 后宣布将把中国债券市场纳入其旗下债券指数,表明国际投资者配置人民币资产、投资内地债券市场的需求不断增强。“债券通”初期 先开通“北向通”,并且没有投资额度限制,未来将适时研究扩展至“南向通”。了解中国发行人和在岸市场,对于全球中国债券市场 机构投资者都是至关重要的。自7月3日“债券通”开通以来关于中国债券市场的监管政策解读,评级的隐忧、会计准则、企业违约等诸 多话题需要深入探讨,所以此次中国国际(香港)债券市场论坛恰时可以帮助解决这些需求。

In recent years, China remains high-speed growth in economics, and has made significant achievement in development of bond market, continuously increasing the attractiveness of RMB bond capital. International bond index providers like Bloomberg Billionaires Index, Citibank included China’s bond market into their indexes, showed that there is an increasing demand of international investors to allocate RMB capital and investment the bond market in the Mainland China. In the early period of “Bond Connect”, the “North China Connect” will be firstly connected without limit on investment amount, while “South China Connect” requires further research at present. The important decision of China attracted international concerns on China’s financial market. Understanding Chinese issuers and onshore markets is crucial to global Chinese bond market institutional investors. Since the opening of the "Bond" on the Chinese bond market since July 3 to interpret the regulatory policy, the rating of hidden worries, accounting standards, corporate defaults and many other topics need to be discussed in depth, so the China International (Hong Kong) bond Market Forum can help resolve these needs.

探讨开通“债券通”对于内地与香港债券市场的深远影响

Discuss the profound influence of “Bond Connect” on bond market of the Mainland China and Hong Kon g;

分享中国信用债券市场的机遇、风险及对策

Share the opportunities, risks in China’s credit bond market and countermeasures there for

汇聚国际权威的债券投资市场行业领袖,思想碰撞

Gather industry leaders of bond investment market with national reputation for communication

加强中国与国际债券市场的合作,提供高效专业的交流平台

Enhance the cooperation in China and international bond markets, provide an efficient and professional exchange platform

探讨中国信用评级与国际信用评级的对比和分析

Have a comparison and analysis on China’s credit rating and international credit rating

探讨中国宏观经济视角的分析,为外资机构投资者带来最新的研究

Have an analysis on China’s macro-economics, introduce latest research achievements to foreign investment institutions

在开通“债券通”背景下,探讨内地与香港的债券监管政策分析及建议

Have an analysis on policies of the Mainland China and Hong Kong on bond supervision under the background of “Bond Connect” and make suggestions

解读中国会计准则与国际会计准则的区别及发展趋势

Interpret the difference between Chinese accounting standard and international accounting standard and the development trend thereof

谁应参加?

Who Should Participate in the Forum?

●监管机构

●经济学家

●商业银行

●保险公司

●证券公司

●基金管理公司

●会计师事务所

●律师事务所

●咨询公司

●交易所

●交易平台

●Regulatory Agencies

●Economists

●Commercial Banks

●Insurance Companies

●Security Companies

●Fund Management Companies

●Accounting Firms

●Law Firms

●Consulting Companies

●Exchanges

●Transaction Platform

查看更多

通达金融

通达金融

通达金融研究院专注于金融领域,凭借在资产证券化、不良资产和航空金融等金融领域的高专业度和资源优势,每年举办超过12场金融行业国际峰会,24场专题培训,40余场客户定制活动和线下沙龙,超过8000名金融行业专业人士参加活动,与众多业内知名资深专家展开深度合作,为超过100家金融机构提供包括资金、项目、服务商推荐等需求对接中间服务。

会议日程

(最终日程以会议现场为准)

会议日程

(最终日程以会议现场为准)

查看更多

会议嘉宾

会议嘉宾

参会指南

参会指南

费用:5600元

包含两天自助午餐+茶歇+会议资料+同声传译设备。

查看更多

温馨提示

酒店与住宿:

为防止极端情况下活动延期或取消,建议“异地客户”与活动家客服确认参会信息后,再安排出行与住宿。

退款规则:

活动各项资源需提前采购,购票后不支持退款,可以换人参加。

您可能还会关注

您可能还会关注

-

FIS 2026第二届中国金融数智创新峰会

2026-05-28 北京

-

2026水域经济新质生产力发展大会暨第三届长江经济带水域经济博览会

2026-04-23 武汉

-

第三届AOIS中国汽车品牌出海创新峰会

2026-04-10 上海

-

第三届低空经济产业发展论坛2026

2026-04-16 上海

赞助

赞助